Bank account general ledger trial#

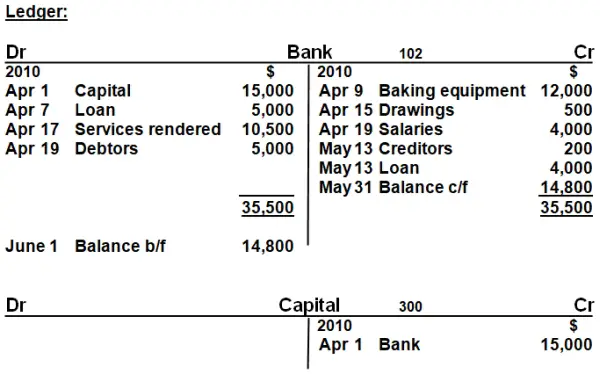

It helps prepare trial balances, an essential requirement for preparing financial statements.Direct expenses include a purchase account where the cost of raw materials has been posted and indirect expenses include day-to-day operational expenses like rent, electricity, maintenance & other utility expenses. It may be direct expenses or indirect expenses. This ledger pertains to all expenses incurred by the entity for the business operation. This includes income from sales, interest, discount received, dividends, and investment (Capital Gains). This ledger pertains to the income earned by the company either from the entity’s main business or other sources.

Drawing will also fall under this ledger. This includes equity, general reserve, and retained earnings out of the profit. This ledger pertains to the money invested in the entity. This sub-ledger includes creditors, long-term borrowings, and short-term borrowing. This also includes current liabilities & non-current liabilities. This ledger pertains to the entity’s financial obligation to the outside. This ledger includes cash, bank, land & building, debtors, Plant & Machinery, Copyright, Trademark, Furniture & fixture. It may be current or non-current, tangible or intangible. All types of assets owned and used by the entity for business operations are recorded under assets.

0 kommentar(er)

0 kommentar(er)